The U.S. Census Bureau, in partnership with the federal department of Housing and Urban Development (HUD), calculate a measure of the percent of household gross income committed to paying for basic housing costs. If more than 30% of household gross income is spent on housing costs, a household is considered housing-cost burdened. The definition of cost burden considers monthly rental fees and utilities for rental housing and mortgage payments, second mortgage payments, utilities, real estate taxes, association fees, and homeowner’s insurance for owner-occupied households.

The concept of measuring a housing-cost burden emerged as a policy indicator during the implementation of the United State Housing Act of 1937 and has been used as a tool to understand trends in housing affordability trends since. Initially, a household was considered cost burdened if spending greater than 20% of household income on housing costs. The policy definition of cost burden has evolved over time. The currently used 30% was adopted in the early 1980s by HUD and has been used as a tool to inform both mortgage-lending policy as well as policy regarding supports for low-income, subsidized housing. Households paying greater than 50% of their gross income for housing are considered severely housing-cost burdened. The paper “Who Can Afford to Live in a Home”, published by the U.S. Census Bureau in 2006, provides a policy history and discussions of methodology and interpretation that remain useful.

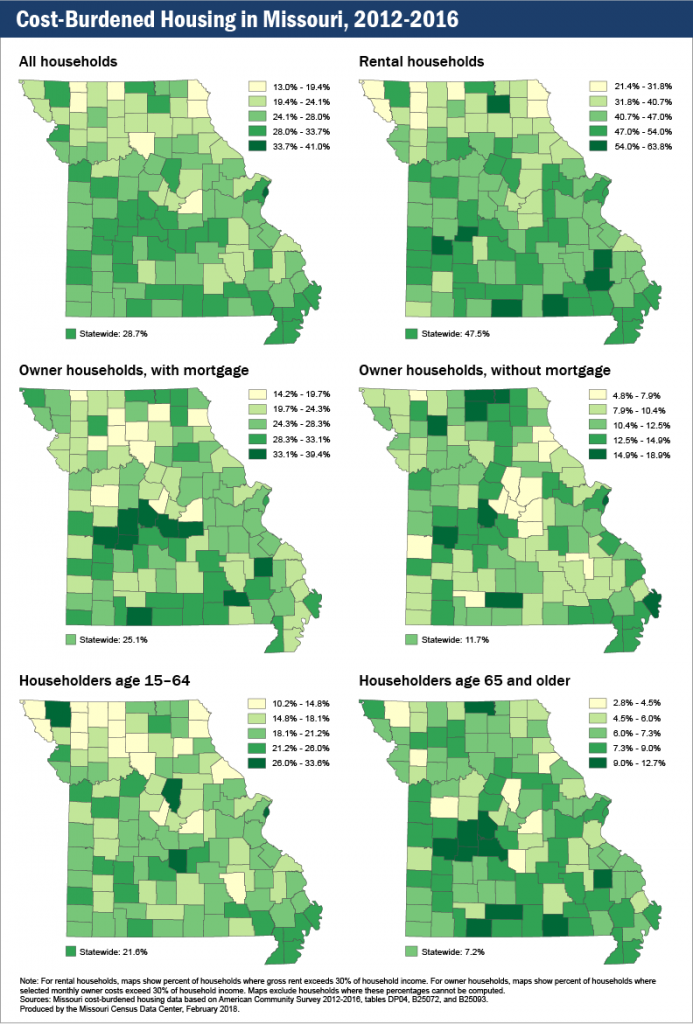

The U.S. Census Bureau publishes 1- and 5-year estimates of this indicator with counties with populations of 60,000+ receiving annual estimates and smaller-population counties an annual 5-year estimate. In order to compare all Missouri counties, these maps consider the most recent 5-year estimate from 2012-2016. To understand the impact of housing-cost burdened households on Missouri’s communities, we have created six maps that consider:

- all households,

- rental households,

- owner-occupied households with a mortgage,

- owner-occupied households without a mortgage,

- households headed by those under age 65, and

- households headed by those age 65 and older.

Approximately 30% of all Missouri households fall into the category of housing-cost burdened, spending 30% or more of gross income on housing costs. Nearly 50% of households that rent are housing-cost burdened, whereas a quarter of owner-occupied households making a mortgage payment are similarly cost burdened.

Approximately one in five households led by householders younger than 65 are cost burdened, and approximately 7% of senior householders fall into this category.

A careful consideration of these maps provides some surprises to the conventional wisdom that housing costs tend to be greater in higher-population-density areas. It’s important to keep in mind that the housing-cost burdened indicator is measuring the ratio of household income required for shelter to what is available for other household needs. Simply, whereas housing costs and values do tend to be higher in more population-dense areas, wages tend to be too. When considering the distribution by quintiles across Missouri counties, generally, southern Missouri households are more likely to be cost burdened compared to their rural northern Missouri neighbors. As a region, the Lake of the Ozarks/Truman Lake area is the densest area of cost-burdened owner-occupied housing as well as senior housing, at least partially accounted for by the region’s desirability as a retirement and/or second home destination. For seniors, the Branson area also has a high percent of both senior and renter households paying 30% or more of their gross household income on housing costs. The I-70 corridor, including Kansas City, Columbia, and the St. Louis metropolitan area tends to be most expensive for renters and households under 65.