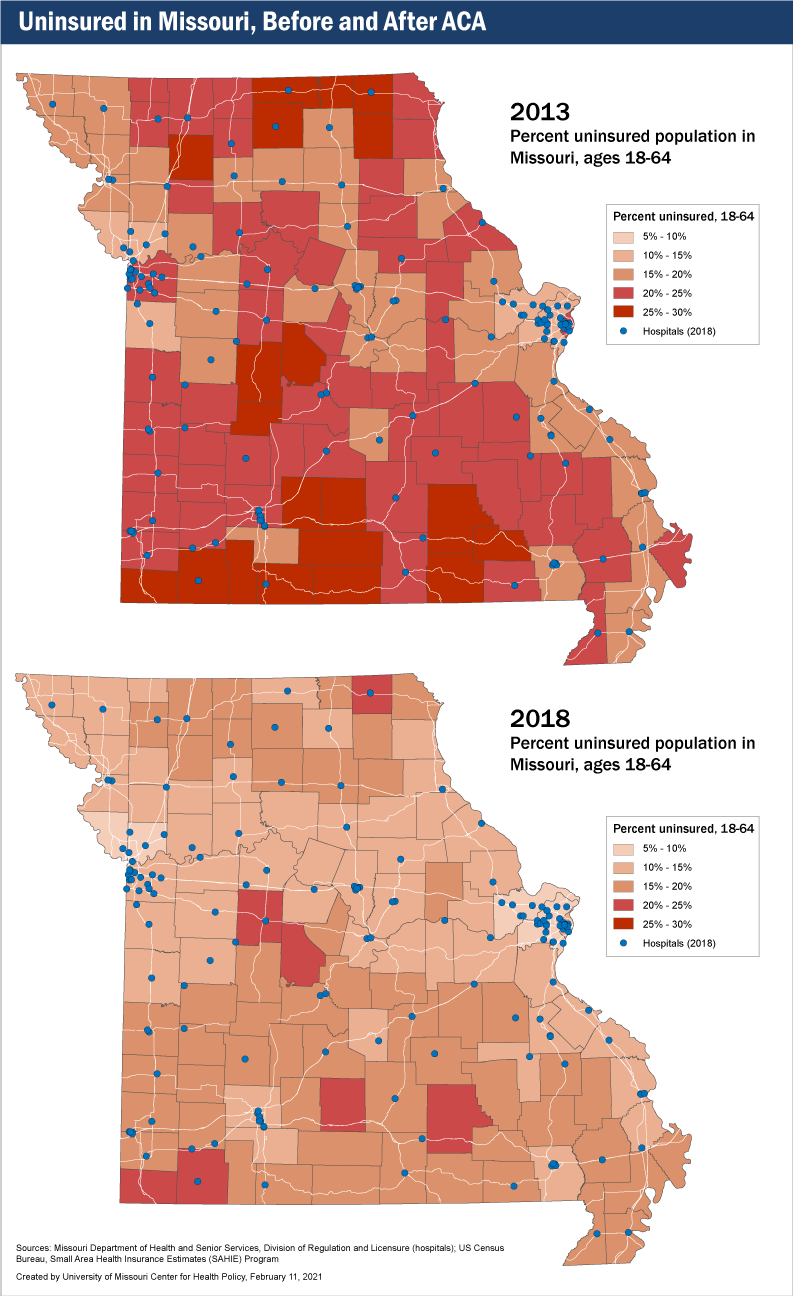

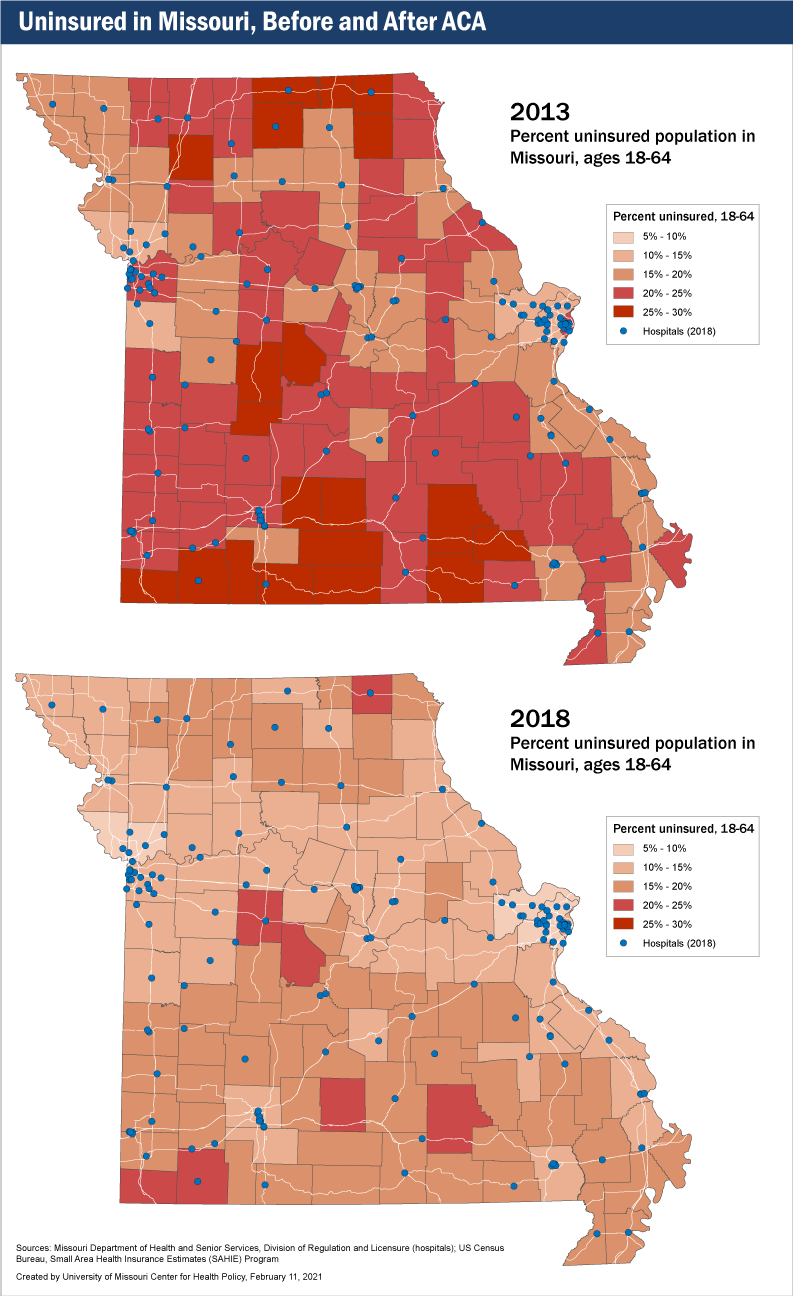

In March 2015, the U.S. Census released the 2013 data collected by the Small Area Health Insurance Estimates Program (SAHIE). The SAHIE data is a valuable reference that provides annual estimates of health insurance coverage for every county in the United States. That year, MCDC published a map showing insurance coverage rates for Missouri counties. The 2013 SAHIE data was of particular interest, as that was the last round collected before the first enrollment period of the Affordable Care Act (ACA, or “Obamacare”).

More than five years have passed since the Affordable Care Act was enacted, and we now have an opportunity to compare rates of uninsured persons across Missouri between 2013 and 2018. These two maps both use SAHIE data and the same value scale. (Note that the 2013 map shown here differs slightly from the one we published in 2015. This is due to a different classification scheme, but the underlying data is the same.)

Taking a look first at the 2013 map, we can see that the percentage of uninsured working adults aged 18-64 in Missouri ranged from a low of 11.6% in St. Charles County to a high of 29,3% in Knox County. All counties in the state had an uninsured working population of 11.6% or greater.

The picture is quite different in 2018. Almost all Missouri counties now have uninsured rates of less than 20%, with many under 15%, especially in the central areas of the state. A few counties in the Kansas City and St. Louis areas have uninsured rates of less than 10%.

More significantly, the number and rates of Missouri’s most-uninsured counties have gone down substantially. In 2013, there were 20 Missouri counties where more than a quarter of the adult population were uninsured. By 2018, there were none.

Despite the differences in uninsured rates over the five-year period, one thing hasn’t changed much: The number of hospitals. In fact, between 2013 and 2018, the number of Missouri counties that lack a hospital increased from 41 to 46, according to the Missouri Hospital Profiles By County list, maintained by the Missouri Department of Health and Senior Services (DHSS).

However, only eight of those counties — Hickory, Knox, McDonald, Morgan, Ozark, Shannon, and Wright — had uninsured populations of 20% or more in 2018. That compares with 15 counties without hospitals that had uninsured populations of 25% or more in 2013. So, the overall picture for access to affordable health care has improved.

In addition, the DHSS list of hospitals does not include smaller facilities such as rural clinics, which can better serve a rural population with higher insured rates.